Know How GST Has Made Changes In The Real Estate Sector

GST is the Goods, and Service Tax levied for most of the businesses of India. It is a kind of service tax.

The GST rates have been changed recently, and it is up to the real estate developer to choose the old GST rate or new GST rate. The early GST rate had the benefit of the input tax credit, which does not apply to the old GST rate. Anyhow the real estate buyers would not face difficulties with the current GST rates. In this article, we would talk about GST and its effect on the real estate business.

GST And Real Estate

In the past, the GST with the input tax credit benefit was 12 percent for real estate properties. It was 8% for affordable housing. After the revision in the GST tax rates by the Central Government, the GST rates were reduced to about 5% for real estate and 1% for affordable housing. , and this made the real estate developers unhappy. Thus Government offered a choice for the real estate developers to choose either the old GST rate or new GST rate. Read More about the GST on Real estate.

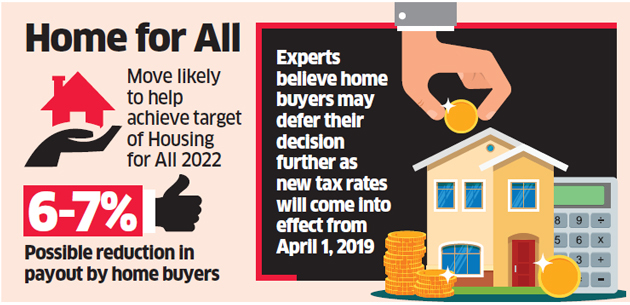

The recent changes made in GST rates would be beneficial to people for whom the input stock is accumulated. The construction projects that have been started before April 1st, 2019 can choose any of the tax rates. But the construction projects that commenced after April 1st, 2019 must follow only the new GST rate. Real estate experts had expected this recent change on the GST rates announced by the central government. The recent change in the GST rates does not affect the prices of homes. The real estate developers cannot increase real estate rates.

New GST Rates

Recently the GST council met and came up with a transition plan for implementing the new GST rates. This new GST rates announced would be applicable from April 1st, 2019. Thus it is up to the real estate developer or homeowners constructing building before April 1st, 2019 to choose either the old GST rate or the new GST rate. According to the new standards mentioned, GST would be levied for 5% for real estate properties and 1% for affordable housing properties. A residential house or plot comprising of 90 sqm is called as an affordable housing property. The GST council has also decided that the procurement of materials for construction purposes must be from only registered dealers. The commercial spaces are considered as residential for 15% for calculating the GST. It is, of course, difficult for tier 2 and other smaller cities to meet the 80% procurement criteria from registered dealers.

It would take some time to know if the new GST rates can create a significant impact on the real estate sector, which is currently facing various challenges. The GST council has decided to make use of the input tax credit on a proportionate basis. There would be a clear segregating of projects that are under construction and new projects so that builders would benefit from the input tax credit.

GST Impact

GST would create a significant impact on the real estate sector. Thus it would influence the buyers, real estate developers, and stakeholders. GST would be levied only for houses or building that are under construction. Thus completed real estate projects are not bound to GST reforms. Therefore there would be a decrease in the price of ready to sell properties. This would be beneficial to buyers. Buyers must follow wait and watch approach so that they can understand the effects of GST with property prices. With the new GST regime, the construction cost has been reduced due to the input tax credit. Thus real estate developers, construction engineers, contractors benefit from the GST reforms. The GST rates also have a positive impact on other stakeholders like labor, material suppliers, etc. The effect on stakeholder is based on tax levied on the goods and services used for construction.

The above inputs offer a clear insight into the GST reforms in the real estate industry.

Leave a Reply